Sustainability Bonds Are Poised To Become The Next Big Thing

In 2021, being sustainable isn’t just something companies do to appeal to consumers — it’s vital to their survival. Customers, employees, shareholders, and regulators are all demanding meaningful action on environmental and social issues. One ingredient makes that possible: money. Measures like installing renewable energy systems and transitioning to green fleets, while they might pay off in the long run, require a significant upfront investment and can be cost-prohibitive for businesses with a limited budget. Nevertheless, many companies have found creative ways to raise funds for their sustainability initiatives while attracting a broader range of investors. One such strategy that’s gaining steam is to issue sustainability bonds.

What are sustainability bonds?

Sustainability bonds are financial instruments where the proceeds will go toward financing projects that provide environmental and social benefits. Major companies, including Aflac and Google parent company Alphabet, have recently been using this strategy.

The History of Raising Funds for Sustainability Initiatives

However, the story actually goes back much further. In 2007, the European Investment Bank issued the world’s first green bonds — called Climate Awareness Bonds (CAB) — as a way to appeal to conscientious investors. Proceeds from these bonds were earmarked for projects in renewable energy, energy efficiency, and climate change mitigation.

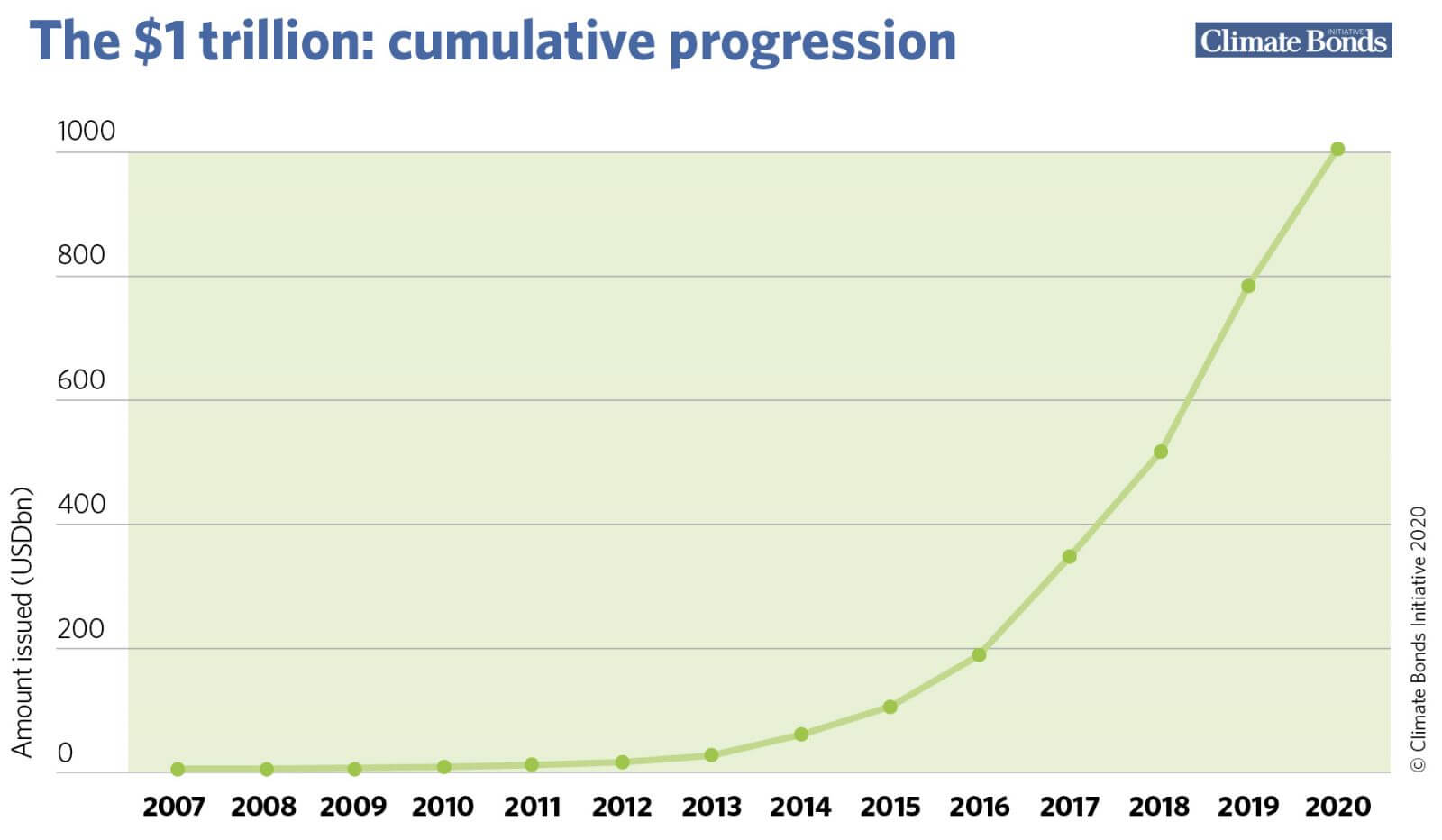

Since then, the green bond market has grown exponentially. To date, $1 trillion in green bonds have been issued, according to the Climate Bonds Green Bonds Database. Despite the pandemic and economic downturn, which has affected nearly every segment of the market, the demand for green bonds isn’t slowing down: A whopping $222.8 billion worth of green bonds were issued in 2020.

Source: Climate Bonds Institute

Today’s Initiatives

As concerns about climate change and social justice escalate, investors increasingly see ESG as a way to mitigate portfolio risks. This offshoot of this has been the rise of sustainability bonds.

In contrast to green bonds, sustainability bonds include both environmental as well social initiatives. By integrating a broader range of efforts, sustainability bonds reflect a growing awareness among executives and directors that ESG has gone mainstream in the investment community.

Indeed, Deloitte predicts that ESG-mandated assets could make up half of all professionally managed investments by 2025, totaling $35 trillion. Clearly, there’s huge potential for companies to tap into this growing pool of ESG-focused investors.

The proceeds from sustainability bonds provide companies with much-needed capital to scale up their environmental and social initiatives. For example, water midstream company Solaris Midstream Holdings recently issued $400 million in sustainability bonds. The company, which recycles produced water from oil and gas extraction, will use the bond proceeds to support additional growth opportunities.

Alternatives to Sustainability Bonds

Sustainability bonds aren’t the only form of financing that’s being linked to environmental initiatives. In the past few years, transition finance has also been gaining momentum. Unlike sustainability bonds, which focus on activities that are already green, transition finance offers financial support to help heavy polluters scale up their decarbonization efforts. This is particularly important in “hard to abate” sectors such as oil and gas, cement, plastics and chemical production, and transportation.

For organizations, these investment vehicles will provide more funds to tackle their sustainability initiatives. Of course, there are strings attached. While no universal disclosure criteria for sustainability bonds exists, companies are generally expected to provide investors with a reporting of how bond proceeds were used and the impact on environmental and social factors.

In contrast to sustainability bonds, sustainability-linked bonds are tied to key performance indicators. Companies that fail to meet targets like recycling and emissions reductions typically agree to pay more interest. As such, companies that plan to issue sustainability bonds or sustainability-linked bonds will need to consider how to measure and report on these metrics.

Improve your sustainability reporting with Lisam

At most organizations, data collection and reporting is a time-consuming manual process. One element that can help issuers meet the demand for impact reporting is ESG management software. Effective ESG software includes action plans and customized reporting options. This makes it easier for managers to measure progress against goals and make strategic decisions. Data can be captured at the source and analyzed efficiently to report on key metrics like greenhouse gas reductions and energy efficiency gains.

At Lisam, we offer flexible, affordable solutions designed for companies with high volumes of data and complex reporting needs. To learn more, fill out this form to request a demo.