What is ESG Materiality?

ESG reporting is a way to inform your investors, customers, and other stakeholders about your company’s environmental and social impacts. It typically includes data collected on metrics like GHG emissions, total water consumed, waste generated, and so on. However, you can’t just report on any old metrics. It’s essential to know which sustainability topics are most relevant to your business and stakeholders, and even more so which associated metrics to report. This will vary by industry and from one business to the next, so it’s important to think carefully about who you’re reporting for and why you’re reporting in the first place. It all comes down to materiality.

While you may have heard this term before, you might be wondering what materiality is in reference to ESG and how it is determined.

In this article, we’ll define ESG materiality and explain what factors go into establishing materiality when it comes to ESG.

What is ESG materiality?

In simple terms, ESG materiality refers to whether or not a piece of information is relevant and important to a company’s environmental, social, and governance reporting. If an item is material, it should be included in the company’s sustainability report. If not, it should be left out.

Materiality is a term that is used in many different contexts, including law, auditing, and accounting. Different contexts may apply the term in slightly different ways. For example, materiality in accounting refers to the relative size of an amount, with relatively large amounts of money being considered material and relatively small amounts immaterial. The common thread is that materiality refers to whether or not something is both relevant and important. Or ‘material’, to the issue at hand.

In addition, different ESG standards organizations may have different definitions of materiality. For example, GRI defines materiality as topics that “may reasonably be considered important for reflecting the organization’s economic, environmental and social impacts, or influencing the decisions of stakeholders”.

IIRC, on the other hand, approaches materiality from the perspective of ESG investors. They state that “a matter is material if it could substantively affect the organization’s ability to create value in the short, medium and long term”.

Regulators and lawmakers may also have their own standards for materiality. In interpreting federal securities laws, the Supreme Court has held that a fact is material if there is “a substantial likelihood that the…fact would have been viewed by the reasonable investor as having significantly altered the ‘total mix’ of information made available.”

How do you determine materiality?

Given that materiality directly influences which ESG metrics you’ll collect and report, it’s important to approach the process carefully. The way you can do this is through a materiality analysis.

What is materiality analysis?

A materiality analysis is used to determine which sustainability topics your organization should prioritize. In turn, it determines what should be included in your ESG reports.

First, you’ll need to determine which topics are important to your stakeholders. This is usually done by conducting surveys or holding conversations with all the different parties that contribute to or are impacted by the organization. This may include employees, customers, suppliers, business partners, communities, investors, and regulators — to name a few.

You’ll also need to consider which topics likely to have a social, environmental, or economic impact in your value chain. In other words, the topics you select should be strategically relevant to your organization.

From there, you’ll need to determine which information to disclose about material issues. Understanding what’s most important to internal and external stakeholders, as well as how the data will be used, can help you decide which information to include.

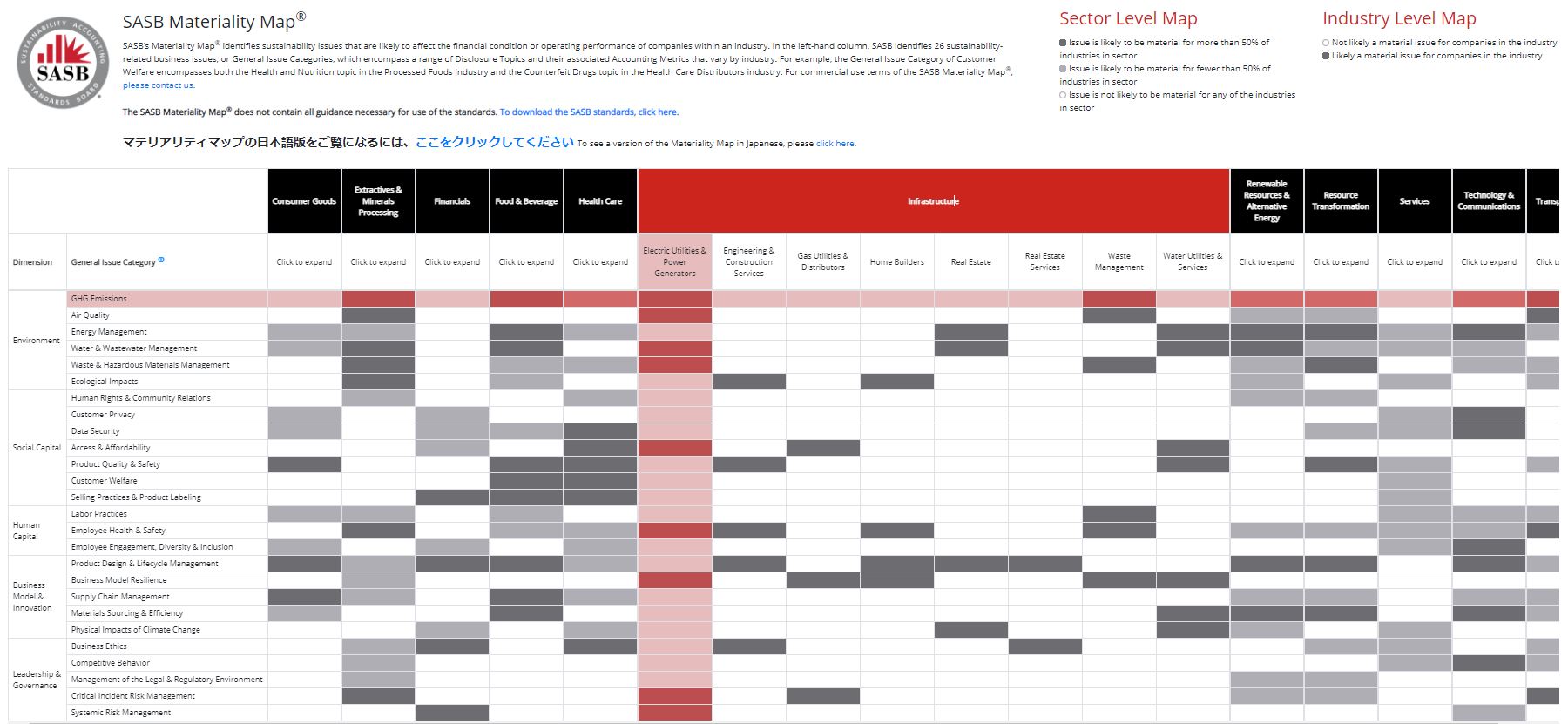

Source: SASB

If you know which ESG reporting framework you plan to use, this can go a long way toward helping to identify material topics and their associated metrics. Take SASB for example. The SASB standards include a an ESG materiality assessment map (shown above). It identifies and compares disclosure topics across different industries. For each topic, SASB has outlined specific accounting metrics that can be used for the purposes of reporting.

Ultimately, though, it’s up to you to determine which topics are material to your organization and what information should be disclosed.

ESG materiality is subjective

Each industry, context, and reporting framework has its own definition of ESG materiality. The concept of materiality all comes down who is using the information and how they are using it.

Information might be material to one group of stakeholders but immaterial to another. That’s why it’s so important to conduct an ESG materiality assessment. This will help you determine which information to collect and include in your reports and which information to leave out.

Lisam offers a simple, affordable ESG management software to streamline data collection and sustainability reporting. Learn more by requesting a free demo today!